💵 USDC vs USDT vs DAI: What’s the Difference Between the Top Stablecoins?

Stablecoins peg to the U.S. dollar to reduce volatility—but they’re not all built the same. Here’s how USDC, USDT, and DAI compare so you can choose the right one for trading, saving, or DeFi.

🧩 What Are Stablecoins?

Stablecoins are cryptocurrencies designed to maintain a steady value—usually pegged 1:1 to the U.S. dollar. They combine crypto’s speed with fiat stability.

- Move funds between exchanges quickly

- Park profits during market swings

- Access DeFi yields and lending

- Trade crypto pairs without cashing out

💠 USDT (Tether)

Launched: 2014 | Issuer: Tether Limited | Peg: Fiat-backed reserves (cash, T-Bills, other assets)

Pros

- Largest liquidity and exchange support

- Fast transfers with low on-chain fees on certain networks

Considerations

- Transparency and audit debates

- Centralized; balances can be frozen in rare cases

💎 USDC (USD Coin)

Launched: 2018 | Issuer: Circle (with Coinbase origins) | Peg: U.S. dollars & short-term Treasuries

Pros

- Emphasis on transparency and compliance

- Broad DeFi and exchange support

Considerations

- Centralized; freezing possible in compliance events

🧠 DAI (MakerDAO)

Launched: 2017 | Issuer: MakerDAO protocol | Peg: Overcollateralized crypto (ETH, USDC, and others)

Pros

- Decentralized and censorship-resistant design

- On-chain transparency of collateral and governance

Considerations

- Can experience temporary peg deviations in extreme volatility

- Mechanics are more complex for beginners

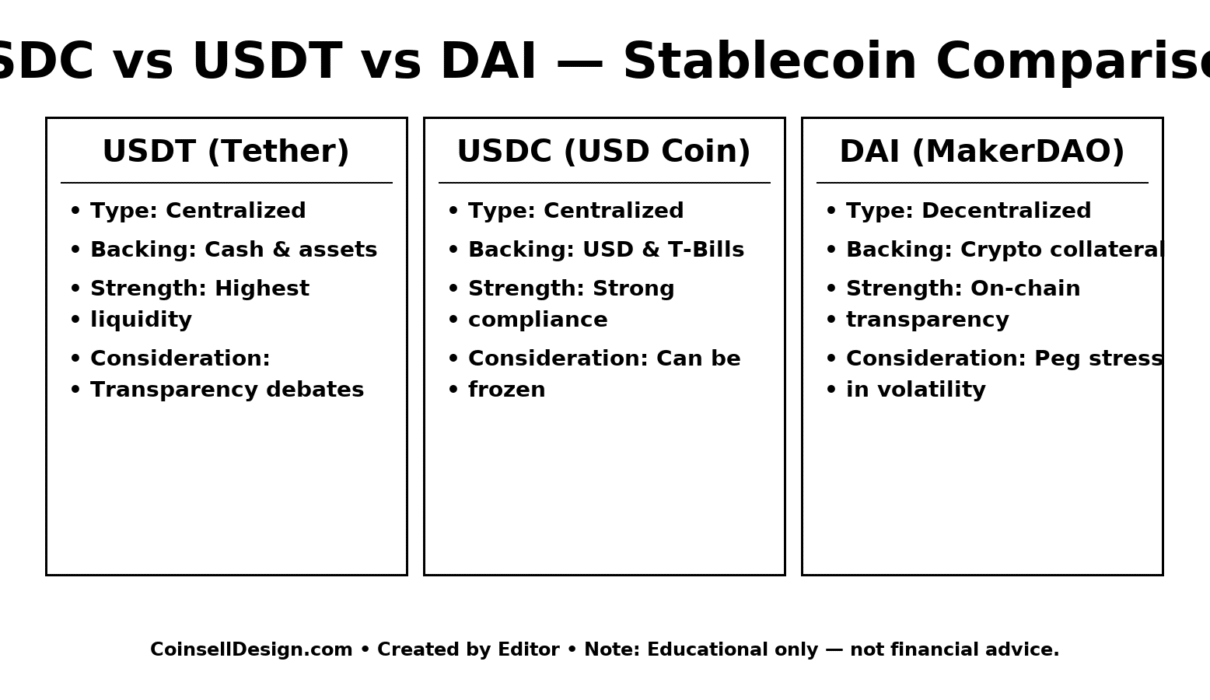

⚖️ Side-by-Side Comparison

| Feature | USDT (Tether) | USDC (USD Coin) | DAI (MakerDAO) |

|---|---|---|---|

| Type | Centralized | Centralized | Decentralized |

| Backing | Cash & assets | USD & T-Bills | Crypto collateral |

| Transparency | Lower | Higher | On-chain |

| Best Use | Trading liquidity | Compliance & reputation | DeFi lending/staking |

| Risk Level | Moderate | Low | Medium |

🏁 Which One Should You Choose?

- For trading: USDT is typically the most liquid across exchanges.

- For transparency & compliance: USDC emphasizes audits and regulatory posture.

- For decentralization & DeFi: DAI offers on-chain governance and collateral visibility.

🛡️ Safety Tips

- Diversify across stablecoins if you hold large balances.

- Prefer hardware wallets or reputable custodians; double-check networks before sending.

- In DeFi, mind liquidation risks for collateralized positions.

- Always verify smart-contract approvals and revoke when no longer needed.

❓ Quick FAQ

Can stablecoins depeg? Yes—extreme market stress or issuer issues can cause temporary deviations from $1.

Are yields on stablecoins risk-free? No—yields imply risk (counterparty, smart-contract, market).